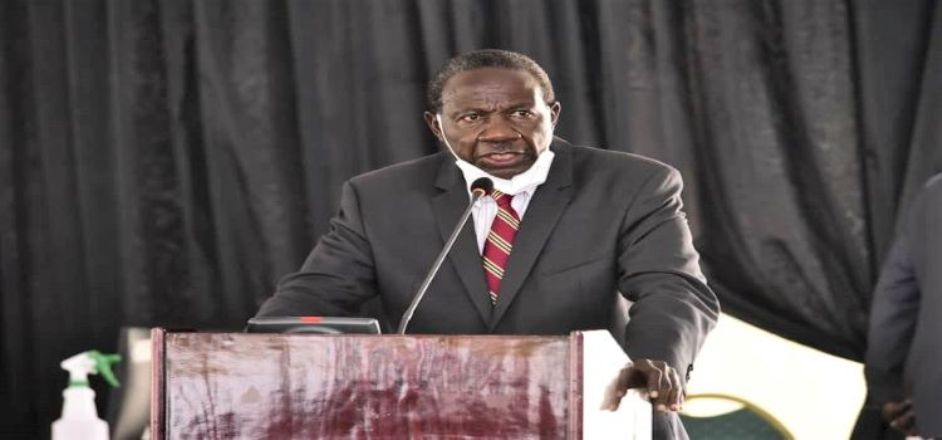

Sseggona chaired the committee meeting

Legislators on the Public Accounts Committee have put officials from the Ministry of Finance, Planning and Economic Development to task on why tax exemptions do not cut across businesses.

The MPs raised the matter in a meeting with the ministry officials led by the Under Secretary, Dr. Edward Sengonzi Damulira who appeared before the Committee chaired by Hon. Medard Sseggona to respond to queries raised by the Auditor General for the financial year ended 30 June 2021.

According to Sseggona, there are companies that have the ability to pay but are exempt from tax.

“Do we have a policy on tax exemption? Who exempts and what are the guiding principles? If I want to be exempted, what criteria do I have to satisfy? In our economic understanding, you are collecting too much from too few,” Sseggona said.

Moses Kaggwa, the Director in charge of Economic Affairs at the ministry said the exemptions are catered for in the tax laws passed by Parliament.

He said business investments that prove to Uganda Revenue Authority (URA), to be using over 75 per cent of raw materials and workforce from Uganda, have a high chance of being tax exempt.

“For example, if you are in the business of agro-processing and you have invested US$10 million as a foreigner, or US$750,000 or US$250,000 as a citizen outside urban areas, then you are entitled to a 10 year tax holiday,” Kaggwa said.

He added that the ministry has designed a Tax Expenditure Framework that will enable the review of all tax exemptions to see if they have achieved the intended objectives regarding employment, value addition, export promotion and foreign exchange income, among others.

“The Auditor General’s office is also carrying out a parallel study on tax exemptions, and this will inform us on the next direction we can take,” said Kaggwa.

Sseggona tasked Kaggwa to present a timeline for the plan to reconsideration of the tax exemptions. Sseggona also cited companies with tax holidays that close shop in a period close to the expiry of the tax holiday and end up registering anew.

“You find that they keep metamorphosing into new companies and for the entire duration of their stay here, they do not pay tax. Some of these companies do not even fall in the category of strategic investments,” Sseggona said.

He added that, ‘you could advise us if it is not logical to simply provide for less other than taking away the obligation to pay taxes. Where they would ordinarily pay 30 per cent, you could deduct 10 per cent’.

Hon. John Amos Okot (NRM, Agago North County) observed that unfair tax exemptions hindered the growth of some businesses in the country and tasked the ministry to present a list of local and foreign investors who have benefitted from tax exemptions in the last three years.

“You will find that one of two businesses dealing in the same products has been given a tax holiday. This means the tax exempt person will sell at a low price at the expense of the one who has pad the burden of taxes,” Okot noted.

Hon. Stella Atyang (NRM, Moroto District) described tax exemptions as leakages in revenue collections that have been misused and hindered government’s progress in meeting its demands.

The Under Secretary said there are ongoing discussions on tax exemptions and payment of Value Added Tax (VAT).

“We are sensitive in balancing the pressure we have to collect revenue and grow the economy,” Sengonzi Damulira said.