Justice Irene Mulyagonja, the Inspector General of Government (IGG) has observed that the on-going probe on Bank of Uganda ( BoU) is a result of poor governance practices.

Mulyagonja says that failure to enforce good governance practices enabled corrupt officials at Central Bank to engage in corrupt tendencies. She stressed the need to increase accountability for governance in the fight against corruption.

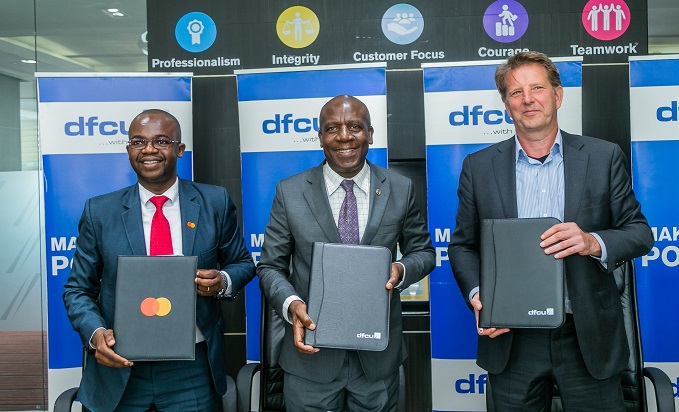

The parliamentary committee on Commissions, Statutory Authorities and State Enterprises (COSASE) is currently probing BoU’s decision to close 7 banks namely; Tefe Bank, International Credit Bank Ltd, Greenland Bank, The Co-operative Bank, National Bank of Commerce, Global Trust Bank and the sale of Crane Bank Ltd to DFCU in 2016.

The committee also found that the International Credit Bank (ICB) was fraudulently closed in 1998 while the 35-year-old Cooperative Bank that was closed in 1999 was closed unclear circumstances with no report from BoU.

Speaking at a media briefing, Mulyagonja said that preventive measures such as civic engagement of citizens to be able to demand for accountability from their leaders as well as increased government accountability are more effective than investigations, arresting and prosecuting those involved in corruption cases.

According to Mulyagonja, over the past three years, her office has managed to investigate and prosecute a total 142 public officials out of which 99 were convicted, accounting for 69.7 per cent of the cases prosecuted.

Mulyagonja also says that there are no significant gains by arresting and prosecuting since the chances of recovering the money are low.

She calls for major focus on preventive measures rather than carrying out investigations after damage has been made.

–URN