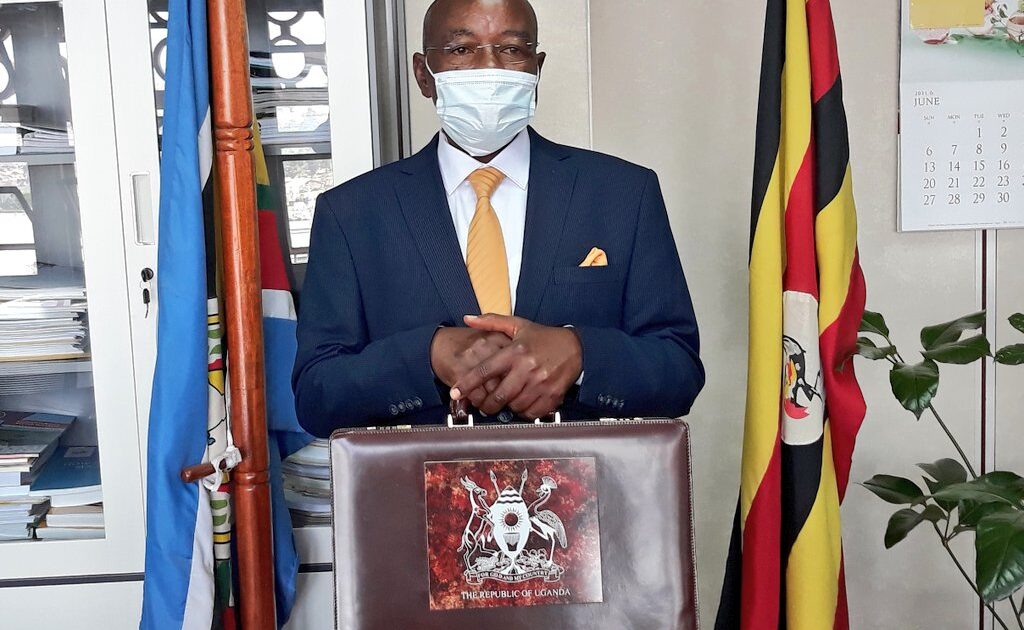

Amos Lugoloobi, the state minister for Finance in charge of planning (Designate) read the budget on behalf of President Yoweri Museveni

Several countries in the East African Community bloc plan to increase expenditure over the next year, as they seek to boost growth which was impacted by the COVID-19 pandemic.

The countries continue to rely heavily on borrowing although some, like Uganda, intend to reduce how much they borrowed this year. In total, the countries plan to borrow more than USD 18 billion, to fund the turnaround of the economies battered by COVID-19, as well as ongoing and new infrastructure projects, among other areas.

This is reflected in 2021/22 financial year budgets of the three original members of the East African Community which were presented concurrently on Thursday as per the EAC Treaty

The simultaneous presentation of the budget was agreed as one of the ways to prevent countries from waiting to first see what their counterparts have done before presenting theirs which would have caused unfair and dishonest competition. It was also a step towards harmonizing fiscal policies in the common market.

However, Burundi and South Sudan have always presented theirs at different parts of the year as they are yet to align their financial years with the rest of the Community’s partner states. But unlike previously, Rwanda did not meet this rule and no reason was given by the government for not presenting its budget

In Uganda, President Yoweri Museveni presented a budget of 44.7 trillion Shillings representing a decrease of 714 billion Shillings, more than a third of the country’s economy. The decrease was occasioned by the expected decline in revenue collections arising from the impact of COVID-19 on the economy, while development partners are also expected to reduce their assistance to the country.

Kenya increased her planned expenditure by 5.5 per cent to Kshs 3.1 trillion (101 trillion Shillings), which is 28 per cent of their 2020 GDP. Tanzania’s budget grew slightly to 35 trillion (53 trillion Shillings) and compared to the size of the country’s economy, it is just about a quarter.

Rwanda made the biggest increase in their budget for the year, of 9.8 per cent to 3.8 trillion francs (13.4 trillion Shillings), which is also 37 per cent of their GDP. The countries are also expecting to continue operating budget deficits, the difference between what they expect to raise and the shortfall, measured against the size of their economies.

In a speech read for him by minister-designate, Amos Lugoloobi, President Yoweri Museveni hopes to reduce the borrowing, with the national debt stock due to rise to 52 per cent by the end of next year.

Uganda expects to borrow 2,943 billion Shillings from local sources, while another 6,868 billion Shillings will come from external sources to finance projects. The reduction in borrowing is due to the expected reduction in financing from development partners. This is also expected to cut the budget deficit from 9.8 to 6.5 per cent of GDP.

Economist Ramathan Goobi says this is still a bad situation because the government signed the Charter of Fiscal Responsibility to cap the level of the budget deficit at 3 per cent.

Kenya’s Finance Minister Ukur Yatani’s budget has a deficit of 7.5 per cent of GDP, down from the 8.7 per cent for the current fiscal year ending this month. However, the country’s level of debt will rise above 70 per cent of the economy, for which experts have accused President Uhuru Kenyatta of mortgaging the country. A big part of the borrowing will go towards infrastructure, especially the railway, ports and expressway projects.

In Rwanda, Finance Minister Richard Tusabe told parliament in May that next financial year, Domestic resources will finance 67 per cent of the budget, while 33 per cent will come in form of loans and grants. Of the planned resource envelop, tax revenues will account for 45 per cent, according to the Budget Framework Paper.

Key priorities for the country will include; access to quality health, increasing agriculture and livestock productivity, scaling up social protection coverage and improving the quality of education.

Tanzania’s budget is expected to be funded with 61 per cent of funds from government tax and non-tax revenues, with the rest coming from loans and grants. Finance Minister Mwigulu Nchemba says the country’s debt has risen to Tshs 60 trillion or almost 39 per cent of the GDP.

-URN