Mumba Kalifungwa, Absa Bank Uganda’s Managing Director

Absa Bank Uganda and the International Finance Corporation (IFC), a member of the World Bank Group, have partnered to train over 300 Ugandan small and medium-sized enterprises (SMEs) to help them assess business risks, adapt their business models and navigate the difficult operating environment caused by the COVID-19 pandemic.

The training, held under the Absa SME Academy platform, is in response to the current economic climate and the impact of COVID-19 on SMEs.

Mumba Kalifungwa, Absa Bank Uganda’s Managing Director says, “The COVID-19 pandemic has left a significant impact on Uganda’s SMEs, with nine out of ten businesses reporting an increase in operating expenses, 38% of micro-businesses reporting no access to inputs, and overall, 83% of businesses reporting a decline in the demand for their products, all of which have affected their cost of doing business.”

A report on the impact of the COVID-19 pandemic on Ugandan Micro, Small and Medium Enterprises (MSMEs) by the United Nations Capital Development Fund (UNCDF) stated that recovery for most businesses affected by the COVID-19 pandemic is expected to take more than three months and possibly until the end of the year. 70% of businesses evaluated estimated their recovery time to last more than three months, while 26% envisaged a recovery period of one to three months. Industries with the longest period of recovery include accommodation and catering (58%); production and supply of utilities (54%); real estate (54%); financial industry (44%); and manufacturing (41%).

The SME Academy will train the directors and proprietors of the Ugandan SMEs in financial-related courses led by IFC-certified trainers, helping the SMEs build their capacity to thrive in the current uncertain business environment.

The initiative was introduced in 2019 as an opportunity for Absa to help businesses address their challenges and improve their skills, such as business management, planning and governance.

Manuel Moses, IFC Country Manager for Uganda, says, “Supporting smaller businesses is a strategic priority for IFC in Uganda and across Africa, a focus that has become even more critical since the onset of the COVID-19 pandemic. Our partnership with Absa Bank Uganda is designed to strengthen the Ugandan SMEs and, therefore, strengthen the wider Ugandan economy.”

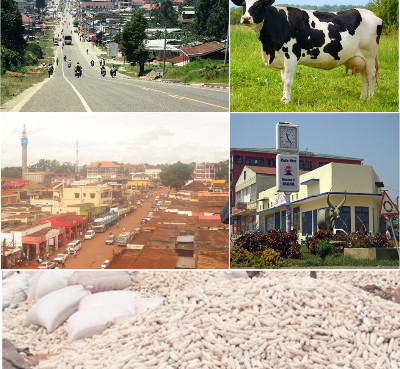

SMEs contributed more than Shs9trillionin domestic tax revenue between 2016 and 2019,contributing over 70% of Uganda’s total gross domestic product (GDP) while providing both formal and informal employment to about 45% of the labour force across manufacturing, commerce, services and other sectors.

Kalifungwa adds, “The banking sector has a critical role to play in post-COVID-19 recovery. Banks have the experience and expertise, for example in conducting risk assessments, which knowledge can be useful to SMEs towards building more sustainable and resilient business models.”