Uganda continues to earn big from coffee exports

Uganda’s coffee exports in July 2024 amounted to 821,593 60-kilo bags, worth US$ 210.48 million (Shs785.35bn), the highest ever in a single month.

According to Uganda Coffee Development Authority (UCDA) monthly report for July 2024, this comprised of 722,444 bags of Robusta valued at US $ 198.00 million and 49,149 bags of Arabica valued at US$ 12.48 million.

This was an increase of 26.15% and 98.68% in quantity and value respectively compared to the same month last year.

By comparing quantity of coffee exported by type in the same month of last Year (July 2023), Robusta increased by 22.16% and 112.07% in quantity and value respectively, while Arabica exports decreased by 17.92% and 0.73% in quantity and value respectively.

The monthly coffee exports volume was higher than the previous year and this was seen in Robusta exports as the newly harvested bigger crop from Greater Masaka and South Western regions reached the market.

Arabica exports were, however, lower than the previous year due to a smaller harvest in Elgon region due to the bi annual off year cycle coupled with poor flowering in the region.

The value of coffee exports was higher in tandem with high global coffee prices as result of dry weather conditions in Brazil and Vietnam that are seen to affect coffee yields and therefore a likelihood of supply deficit in 2024/25.

According to UCDA, coffee exports for twelve months (August 2023-July 2024) totaled 6.30 million bags worth US$ 1.25 billion compared to 5.84 million bags worth US$ 868.53 million in the previous year (August 2022-July 2023).

This represents an increase of 7.94% and 43.94% in quantity and value respectively.

Exports by Type and Grade

UCDA’s report reveals that the average export price was US$ 4.27 (Shs15,926) per kilo, US cents 20 higher than in June 2024 (US$ 4.07). It was US$ 1.56 higher than in July 2023 (US $ 2.71/kilo).

Robusta exports accounted for 94% of total exports, higher than 92% in June 2024.

The average Robusta price was US$ 4.27 per kilo, 20 cents higher than US$ 4.07 per kilo the previous month.

The highest price was for Organic Robusta sold at US$ 4.57 (17,051) per kilo, followed by Screen 18 sold at US$ 4.50 per kilo.

The share of Sustainable/washed coffee to total Robusta exports was 0.86% compared to 0.70% in June 2024.

Arabica fetched an average price of US$ 4.23 per kilo US cents 33 higher than the previous month (US$ 3.94).

The highest price was Mt. Elgon A+ sold at US$ 6.13 per kilo. It was followed by Bugisu A sold at US$ 5.07 per kilo.

Drugar was sold at US$ 4.39 per kilo, 21 cents higher than 4.18 per kilo last month, and was US cents 18 lower than Bugisu AA. Drugar exports were 54% of total Arabica exports the same as the previous month.

The share of sustainable Arabica exports to total Arabica exports was 2%, lower than 4% in June 2024.

Individual Exporter Performance

According to the report, Ugacof (U) Ltd had the highest market share of 16.26% compared to 15.20% in June 2024.

It was followed by Olam Uganda Ltd 10.50% (9.28%); Louis Dreyfus Company (U) Ltd 8.41% (6.42%); Export Trading Company (U) Ltd 6.39% (5.73%); Ideal Quality Commodities Ltd 6.00% (6.90%); Touton Uganda Limited 5.76% (5.88%); Kawacom (U) Ltd 5.52% (3.96%); Ibero (U) Ltd 5.30% (4.49%); Kyagalanyi Coffee Ltd 5.13% (5.29%), and JKCC General Supplies Ltd 4.59% (4.34%).

Note: The figures in brackets represent percentage market share held in June 2024.

“The top 10 exporters held a market share of 74% higher than 67% the previous month reflecting competition at exporter level. Out of the 63 exporters who performed, 37 exported Robusta Coffee only while 8 exported Arabica coffee only,” UCDA says in its report.

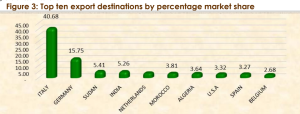

Exports by destination

Italy maintained the highest market share with 40.68% compared to 41.96% last month. It was followed by Germany 15.75% (10.55%), Sudan 5.41% (6.87%), India 5.26% (7.41%) and Netherlands 4.14% (3.56%).

It’s important to note that the figures in brackets represent percentage market share held in June 2024.

The first 10 major destinations of Uganda coffee took a market share of 88.97% compared to 88.83% last month.

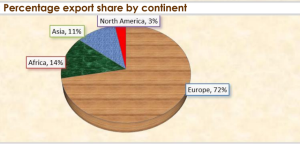

Coffee exports to Africa amounted to 112,713 bags, a market share of 14% compared to 79,433 bags (12%) the previous month.

African countries that imported Uganda coffee included Sudan, Morocco, Algeria, Egypt, Kenya, Tunisia and South Africa.

“Europe remained the main destination for Uganda’s coffees with a 72% imports share, higher than 69% in June 2024,” the report says.

Foreign buyers of Uganda Coffee

The top 10 buyers held a market share of 64% higher than 60% the previous month.

Sucafina led with a market share of 16.64% compared to 15.40% in June 2024.

It was followed by Olam International 10.94% (10.61%); Louis Dreyfus 8.41%; (86.42%); Touton SA 6.49% (6.62%); Bernhard Rothfos 5.30% (4.49%); Ecom Agro Industrial 4.84% (3.71%); Koninklijke Douwe 3.81% (3.29%); Volcafe 3.13% (3.20%); Eurocaf SRL 2.49% (3.81%) and American Coffee 1.95% (1.30%).

Note: The figures in brackets represent percentage performance in the previous month –June 2024.

Global Situation

World coffee production for 2024/25 is forecast to increase by 7.1 million bags from the previous year to 176.2 million due primarily to continued recovery in Brazil and rebounding output in Indonesia. With additional supplies, global exports are expected to increase by 3.6 million bags to 123.1 million primarily on strong shipments from Indonesia and Brazil.

Consumption is seen to be 3.1 million bags higher to 170.6 million.

Ending stocks are expected to rise by 1.9 million bags to 25.8 million following 3 years of decline.

(United States Department of Agriculture, Coffee: World Markets and Trade report-June 2024).

Local situation

UCDA says during the month of July 2024, farm gate prices ranged from Shs5,800-6,000/= per kilo of Kiboko (Robusta dry cherries); Shs.11,500-12,500/= for FAQ (Fair Average Quality); Sh. 12,500- 13,000/= for Arabica Parchment; and Sh. 10,500-11,500/= per kilo for Drugar.

Outlook for August 2024

According to the report, coffee exports are projected to be 720,000 60-kilobags as the main harvest season south of the equator (Masaka and South Western regions) winds up.

Uganda will soon be the pearl of the world.

Uganda will soon achieve more income from coffee and the world at large to get quality products from coffee.

It’s good that Uganda is now producing good quality coffee and in high quantities in comparison of months.