Experts have urged Small and Medium Enterprises (SMEs) to improve the skills of their employees and seize the existing opportunities in order to remain productive and relevant during and after COVID-19 pandemic.

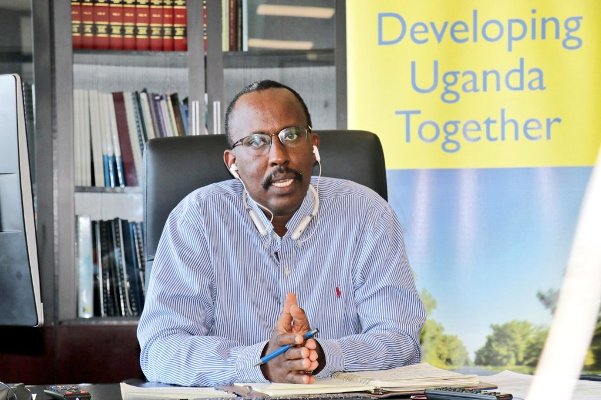

During an online e-skilling conference organized by Private Sector Foundation Uganda (PSFU) and supported by Uganda Revenue Authority (URA) among other partners on Sunday, the URA Commissioner General, URA, John R. Musinguzi (pictured) said that the impact of COVID-19 to the taxpayers’ capacity to pay is under consideration and that there is need to educate taxpayers on the possible ways of respecting their tax obligations including engaging taxpayers to discuss installment payments, extension of filling dates and making returns, while monitoring the ministry of finance to do what’s out of URA’s mandate like tax waving among other measures.

“We need to educate our taxpayers that it’s possible to pay taxes and thrive the business. We know the impact of COVID on the capacity of business. We are engaging our taxpayers to discuss how to pay tax installments, extension of filling dates and making returns as long as they fit in the extension days,” Musinguzi said, adding: “We shall engage them on their rights & obligations and equip them with the tools to improve their Tax Compliance as well as benefit from incentives in the Law.”

For updates and latest info about COVID-19 situation in Uganda, visithttps://bit.ly/2WKANNF

He revealed that when businesses thrive, the economy thrives and can positively impact on government’s ability to fund the national budget.

He added that there is need to deepen the interaction between the taxpayers and URA to observe the obligations of the principal of taxation without conflict including the obligation of the state to collect tax, the obligation of businesses to thrive, make profits and grow and the obligation to God.

Musinguzi encouraged all informal business operators to formalize.

“It will be good for you. Your businesses will become bankable. There is no harm in formalizing a business,” he said.

ALSO READ:

URA Issues Guidelines On How To Quickly Process Tax Refunds

Musinguzi also said that Uganda should focus on home grown solutions.

“We should learn to be inward-looking; we need to know that the solutions for recovery lie within us. Donors will be busy trying to get back on their feet. It is the taxes that will help us build our country to what we would like it to be,” the URA boss said.

He noted that URA will introduce an Electronic Receipting and Invoicing System on 1st July, 2020. This solution, he said, will help especially Small and Medium Enterprises with proper book keeping.

“There is no need to play hide and seek with us. It is not worth it. We purpose to do our best as the authority to help the small taxpayers to make sure they improve their records, from small to large entities,” Musinguzi said.

He added: We will deepen interaction with the taxpayers. It is in our interest that businesses grow and accumulate wealth from which URA will tax. It is not a conflict that one must die for the other to thrive. We are considerate of the times.”

He revealed that one way to encourage Tax compliance is to keep the rules as clear and simple as possible.

“URA has tried to make sure the tax systems, laws and policies are kept simple and tailored to the needs of the small & medium ventures,” he said.

He noted that the tax Authority has maintained operations during COVID-19 to make sure that there is smooth flow of items across the country and outside.

“We are currently engaging Ministry of Finance about providing VAT refunds to help businesses recapitalize,” he said, adding: “We have put all our services online to make sure people can still engage and transact with us. We are also using this break to analyze data. All this is done to make sure we have continuity of business.”

Mathias Katamba, the Managing Director at dfcu bank told business owners especially SMEs that there is need to go back to the basics of running business including creating new experiences, building loyalty of employees, joining skills forums among others to improve their operating models.

He said that there is need for SMEs to constantly communicate with their bankers to restructure loans so that both the bank and customers remain in business.

The Commissioner in charge of BTVET in the Ministry of Education and Sports, Dr. Safina Kisu Musene said that to ensure the challenge of unskilled labour and the mismatch of skills from institutions and the world of work is solved, the ministry has drafted a demand driven and employer led policy with strategies that will ensure employers to incorporate their demands in the curriculum and to produce skills that are required in the field of work.

“As Education ministry, we shall rebrand BTVET, we shall very closely engage private sector employers to produce a relevant curriculum, do assessment together, and cooperate to provide industrial and internship opportunities,” she said.

While a number of businesses especially SMEs have been hit hard by the COVID-19 pandemic, the above tips and reassuring messages from URA give hope that nascent enterprises will survive this crisis and thrive thereafter. Measures unveiled by URA including engaging taxpayers to find a way of paying taxes in installments and the extension of filing returns so that no one will be penalized for filling late is quite commendable and will save many businesses from collapsing.

By Drake Nyamugabwa