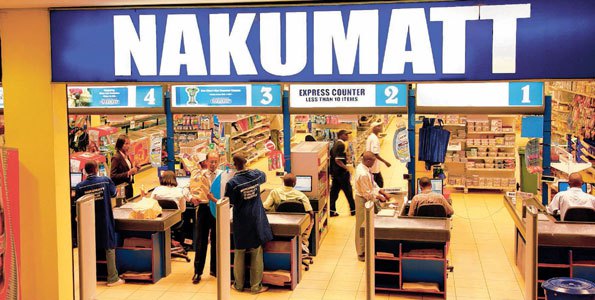

On June28, 2017, ailing regional retailer Nakumatt closed three of its top branches in Uganda. In a statement released by Knight Frank Uganda on Saturday, the retailer, which is wallowing in dire financial woes, said its stores in Acacia Mall; Kololo, Village Mall, Bugolobi and Victoria Mall, Entebbe were on Wednesday last week closed indefinitely. Knight Frank Uganda is the property manager of the malls. “The supermarket space at these malls will go under redevelopment to add additional value to our shoppers and their shopping experience. We humbly regret any inconveniences caused, but keep watching this space to see how your shopping experience is taken to a new level in Uganda,” the statement signed by Knight Frank Uganda head of retail Marc du Toit read in part.

Nakumatt Holdings is now looking for “local and international financiers” for a capital injection.

It is true Nakumatt has had financial troubles-some stemming from mismanagement, but the future of supermarket business in Uganda remains in jeopardy. This is because Nakumatt is not the first supermarket chain to become financially incapacitated.

In 2015, regional supermarket chain Uchumi closed shop in Uganda after failing to become economically viable. The supermarket chain that was cross-listed on the Uganda Securities Exchange owed debts to a number of Ugandans who had supplied it with various items.

Additionally, history shows that pioneer supermarkets are no longer in business.

It should be noted that in early 2000 Uganda witnessed the birth of malls and supermarkets- successful businesses in developed economies. Within a short period, the market pioneers were breaking even as the small middle income class excitedly made supermarkets their one stop-shopping destinations.

Like the culture is in Uganda, the ‘copy and paste’ syndrome took centre stage as ‘shrewd’ investors jumped on the lucrative business. This led to the mushrooming of supermarkets not only in Kampala, but also upcountry towns.

Pioneer supermarkets like Metro Cash and Carry Supermarkets (all from South Africa) disappeared after the entry into the market of Shoprite and Game Store. Metro’s collapse also led to the collapse of its main outlet- Quick Save. Locally owned Star Supermarket also went crumbling due to financial problems coupled with dwindling customer numbers as a result of increased competition.

In 2010, Tuskys made its entry into Uganda by buying out two supermarkets – Half Price and Good Price, but it has since felt the pinch of the Ugandan market.

Tuskys Bulolobi was closed in 2015 and relocated to Bwaise branch which had earlier been closed by Kampala Capital City Authority (KCCA) over selling rotten chicken, beef and expired goods. Shoprite Naalya branch that was housed at Metroplex Mall also closed shop in 2015.

No Longer Profitable

This brief history raises pertinent questions: Why are supermarkets collapsing in Uganda? Can it be blamed on competition? Is it about mismanagement? It is about the ‘weak’ economy? Is it because Ugandans don’t embrace the culture of shopping in supermarkets?

A number of factors explain why a number of supermarkets have collapsed. In fact, many mini-supermarkets have collapsed although they have not been written about.

From the above history, one major factor why supermarkets are struggling in Uganda is the tight competition.

There are many mini-supermarkets compared to bigger ones and these are almost in every area. One doesn’t need to leave his neighborhood to go to the city centre to shop. Mini-shops are fulfilling the needs of many consumers just like supermarkets would.

Increased competition coupled with limited market (demand) has exacerbated the problem. A number of top supermarkets have been on the spot for selling rotten meat and expired goods. What does this point to? The demand is simply small and can’t sustain the existing supermarkets.

It is a fact that Uganda’s middle income class remains small. It is estimated that Uganda’s middle income class is just over Shs2m out of a population of about 36 million people.

Generally, supermarkets are expected to attract high class customers, but Uganda’s per capita income stands at US$ 675.6 as of 2015.

It is also worth noting that about 30% of Uganda’s population is in the money economy as 69.4% of the entire population is engaged in subsistence farming, according to the 2014 National Population and Housing Census Report. This state of affairs explains why supermarkets located in what is considered to be upscale areas like Naalya and Bugoloobi have collapsed.

But even the 30% of Ugandans in the money economy are disputed. According to Oxfam International report launched On March 29, 2017, 10% of Uganda’s population (estimated at 36 million people) own 35.7% of national income -estimated at US$s27bn (about Shs97trn). This means that 3.6 million Ugandans own over Shs34trn of Uganda’s GDP.

The report adds that another 10% (3.6m Ugandans) of Uganda’s population composed of the poorest only own 2.5% (about Shs2.4trn) of the country’s national income.

Although the number of Ugandans living below the poverty line has declined to 19.7% in 2014, down from 56% in 1992, the report notes that income inequality has instead increased. In fact, these poverty figures were based on one dollar being enough for a person a day. However, economists and analysts say, one dollar is no longer enough to cater for one’s daily needs. They argue that for a person to live well a day, he or she needs over three dollars.

Experts’ Take

Charles Ocici, the Executive Director at Enterprise Uganda says that regional and continental supermarkets are failing in Uganda because it is costly to do business in the country.

“Our SMES (Small and Medium Enterprises) are too low and inefficient to justify a presence of a value chain with a leading brand. When Uchumi Supermarket is coming to Uganda, they don’t want to bring items from Kenya or South Africa to be cost effective; they want excellent manufactured goods as well as perishables from here. If you’re going to import such items, it becomes costly and takes a lot of time to stock the supermarket,” he says, adding that international brands want to concentrate on the upper side of the value chain rather than building SMEs.

He adds that running a supermarket requires key competencies like having a solid system to detect theft by the staff and customers.

“If you can’t detect small thefts and manage damages, wastes and expiry of goods, a supermarket will eat you up. Remember the profit margin in a supermarket isn’t large when you’re competing with kiosks,” he says.

Explaining further why supermarket business is no longer lucrative, Ocici says Uganda is still a largely pedestrian population where by many either walk to work or use public means. This, he says, means that many people will either buy their basic needs from the nearest retail shop or on the roadside.

“When it comes to perishables (meat, vegetables, bread, milk etc), there’s variety outside supermarkets which is also fresh. In a supermarket, beef can be in the fridge for more than a week,” he says, adding that even those with vehicles have considerations to make before going to a supermarket.

He says a supermarket could have a seemingly enough parking space only to be congested during peak hours/periods.

He adds that supermarkets also employ many workers who are in most cases idle for they (supermarkets) tend to work during peak hours especially in developing countries like Uganda.

“While in the western world a supermarket is everyday shop, many Ugandans don’t buy domestic items from supermarkets,” he says.

In an earlier interview, Prof. Augustus Nuwagaba, an economic analyst said Ugandans have a low disposable income (money left for spending purposes after paying taxes, fees and medical services) and thus supermarket business can’t flourish.

“How many Ugandans go to supermarkets? Our economy is still small with 69% [of the population] engaged in subsistence farming (producing for own consumption). They (mushrooming supermarkets) are competing for about 15% of the population,” Nuwagaba says.

He adds that urban dwellers are increasingly becoming financially savvy; they are now growing vegetables, so no need to buy them from open markets or supermarkets.

He explains that supermarkets can only flourish with an increase in household income which will automatically increase purchasing power.

“The economy must grow production, employment and monetize the economy. Today, Uganda is a dual economy (monetary and subsistence),” he says, adding that there is “too much oversupply of supermarkets compared to demand” yet starting a supermarket requires a lot of money (sunk costs) for rent (spacious place), items (goods) and lots of staff (guides, tellers and cleaners).

Analysts say starting an average supermarket requires a minimum of Ushs200m.