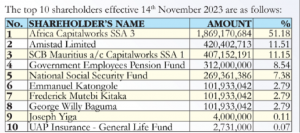

Mauritian based investment company, Africa Capitalworks SSA 3, has completed the acquisition of 51.18% stake in CIPLA Quality Chemical Industries Limited.

Africa Capitalworks SSA 3 (ACW SSA 3) acquired 1,864,299,646 and 4,871,038 Ordinary Shares of Cipla Quality Chemical Industries

Limited (QCIL) from Meditab Holdings Limited and Cipla (EU) Limited, respectively, collectively comprising 51.18% of the issued ordinary share capital of QCIL for USD25 million (94.62bn).

In a statement dated November 14, 2023, Africa Capitalworks SSA 3 said all conditions precedent for the Transaction were fulfilled, including receipt of consents from the Capital Markets Authority (CMA), Uganda Securities Exchange (USE) and the COMESA Competition Commission (COMESA).

A statement from Cipla Quality Chemical Industries Ltd says Emmanuel Katongole, Frederick Kitaka Mutebi and George Baguma have each acquired an additional 1.50% interest in QCIL, which they beneficially own through ACW.

On 12 May 2023, QCIL and members of the Cipla Group entered into three agreements, which became effective upon completion of the Transaction:

a) Technology License Agreement (“TLA”) which preserves QCIL’s access to the technology required to secure its existing business and contracts. This includes the technology relating to Lumartem, TLD and TLE400 which contribute a significant portion of QCIL’s

In terms of the Transaction and the TLA, royalties on these products, which amounted to over USD1.6 million in the year ended 31 March 2023, will no longer be paid by QCIL to Cipla, as they have been incorporated into the terms of the purchase by ACW;

b) Transitional Services Agreement (“TSA”) which, inter alia, maintains QCIL’s access to certain technology and databases for the period required by QCIL to manage its business and establish registrations in its own name, as appropriate; and

c) Manufacture and Supply Agreement (“MSA”), whereby QCIL will continue to supply members of the Cipla Group with an agreed volume of products for three years from the closing of the Transaction.

“This Transaction marks a significant milestone as we embark on a new phase of collaboration with our new controlling shareholder directed at increasing our growth and thereby strengthen the healthcare sector in the Region,” Doreen Awanga, the Company Secretary says on behalf of the Board.

The statement adds: “Our belief in the potential of Africa’s pharmaceutical industry is unwavering and we welcome the opportunity to play a larger role in advancing healthcare accessibility and quality across the continent. With QCIL’s WHO prequalification, which has recently been confirmed for another three years, and cGMP-compliant standing, an independent QCIL will be even better positioned to secure business from customers who recognise and value local manufacturing and the benefits associated with it, such as shorter and more reliable delivery.”

The Company says by combining ACW’s expertise in investment and market dynamics and its complementary relationships with QCIL’s established quality manufacturing presence and reputation in the pharmaceutical landscape, QCIL expects to have additional opportunities for growth as a result of the change in control, which, if realised, will benefit all shareholders.

“The Company name will be changed back to Quality Chemical Industries Ltd as soon as practically possible, and shareholders will be notified accordingly. There has been no change in Management upon conclusion of the Transaction,” the statement says.

Africa Capitalworks SSA 3 (ACW SSA 3) is wholly owned by Africa Capitalworks Holdings (“ACWH”) and was formed to hold and manage ACWH’s interest in Cipla Quality Chemical Industries. ACWH is a Mauritian investment company that provides permanent equity capital and complementary skills to midmarket companies across Sub-Saharan Africa. Three of ACWH’s largest shareholders are British Investment International (formerly CDC), African Development Bank and Government Employees Pension Fund.