The stock of Uganda’s outstanding private sector credit increased by 1.5 percent from Shs16.97 trillion in August to Shs17.22 trillion in September, the Performance of the Economy Report for October released by Ministry of Finance, Planning and Economic Development on November 18, 2020 has revealed.

The increase is attributed to mainly “new credit extensions following the continued improvement in economic activity.”

During September2020, Shs932 billion worth of credit was approved for disbursement to the private sector, the report obtained by Business Focus says.

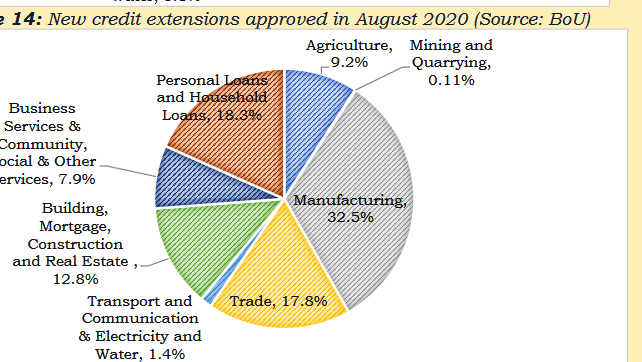

“Of the total loans applied for during the month,73 percent were approved-which is higher than the approval rate of 67 percent recorded in August 2020,” the report reads in part.

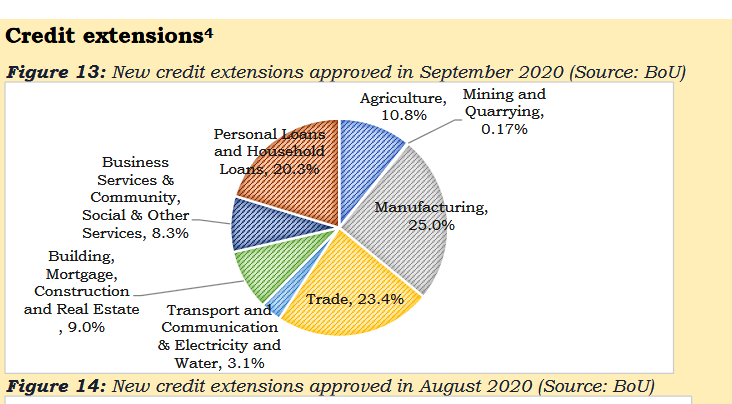

By sector categorization, it adds, manufacturing received the largest share of credit approved in September2020 at 25 percent, followed by Trade at 23.4 percent and Personal loans & Household loans at 20.3percent.

Compared to August 2020, the report says, manufacturing was still the largest recipient of credit approved.

According to the report, average lending rates for Shilling denominated credit increased to 19.9 percent in September, 2020 from 19.8 percent in August, 2020-partly attributed to the risk aversive tendencies of commercial banks.

However, the rates on foreign currency denominated credit remained unchanged at 5.9 percent over the same period, the report says.

“In spite of the slight increase in lending rates, the number of loans approved by commercial banks as a proportion of the total loan application increased to 73 percent during the month of September 2020, up from 67 percent in August 2020,” the report says.