The Uganda Revenue Authority (URA) has revealed that a cross-section of unscrupulous taxpayers have been abusing the VAT regime through the generation of fictitious input tax invoices.

“The fictitious invoices are invoices generated to portray a business transaction while in actual sense there is no genuine supply /movement of goods and/or services,” Doris Akol, the URA Commissioner General says in a statement.

Although the URA instituted a 90 day grace period starting from January 2018 to enable tax payers to rectify their tax returns, some taxpayers did not heed to this call.

The statement further reads: “Accordingly and in line with section 9(5) of the VAT Act and section 5(7) of the Tax Procedures code Act, the Management of Uganda Revenue Authority informs all taxpayers and the general public in Uganda that the following actions have been taken with immediate effect;

1) The registration of the listed taxpayers with URA is hereby cancelled.

2) The input tax arising from the fictitious invoices raised by the listed taxpayers is hereby annulled.

3) All Tax Clearance Certificates (TCC) issued by URA in the year 2017/2018 to the listed taxpayers are hereby revoked.

4) Criminal investigations have also been instituted and further action shall be taken including but not limited to prosecution.

5) The PPDA and other government agencies dealing with the listed taxpayers are hereby informed.”

The affected tax payers are mainly Chinese companies.

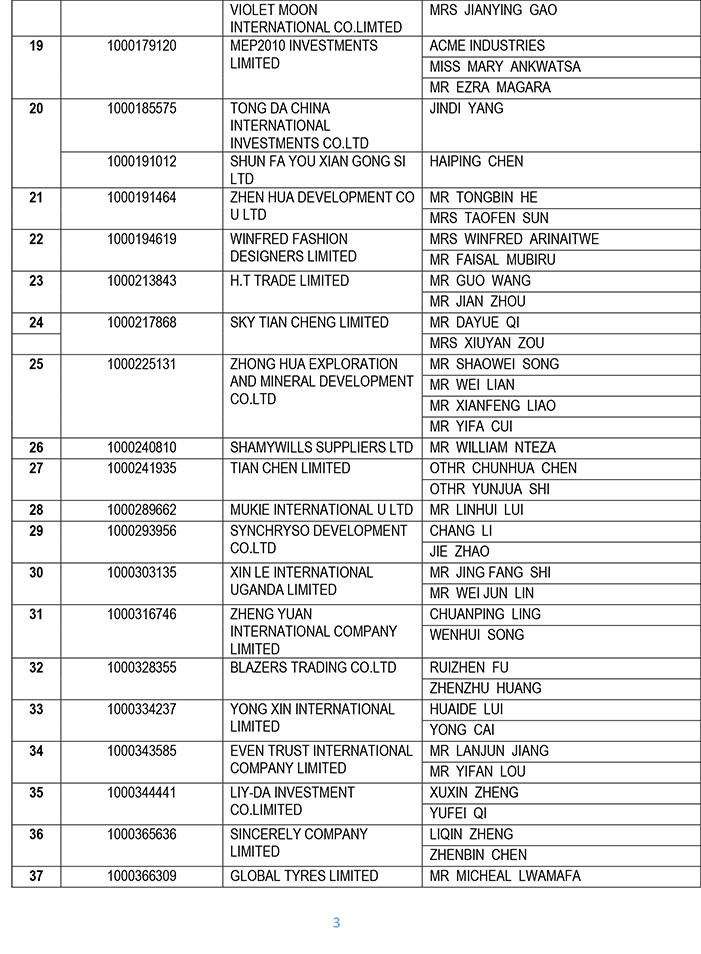

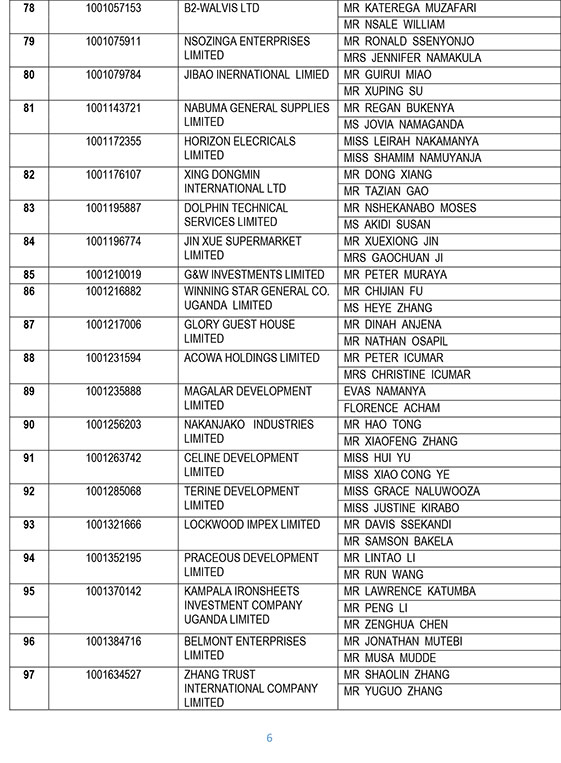

The affected taxpayers are listed below;