The 2018/19 tax-heavy budget has sent many Ugandans’ tongues wagging. The Shs200 daily tax on social media, reinstatement of corporation tax on SACCOs making profits and 1% tax on Mobile Money transactions and 15% on Money transfers are some of the proposed taxes that have received a lot of criticism.

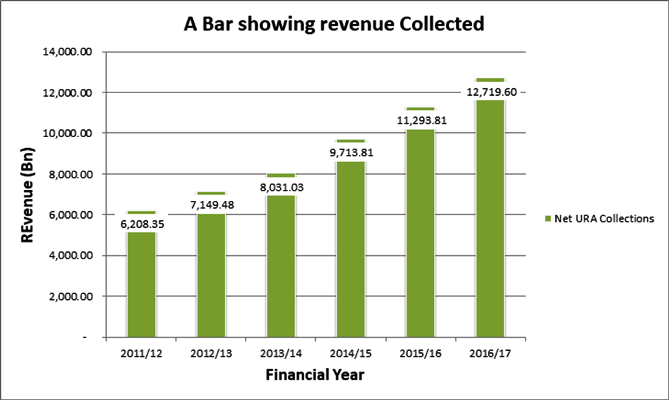

Out of the Shs30.9 trillion 2018/19 budget, Uganda Revenue Authority (URA) is expected to collect Shs16.2 trillion, up from a revenue target of Shs15 trillion in 2017/18 budget.

There are arguments that a few Ugandans are being over taxed, a thing that calls for serious interventions to widen Uganda’s tax base.

As government targets higher revenue collections in 2018, URA decries the informal nature of the Ugandan economy that has left many out of the tax net.

In an exclusive interview with Business Focus, Ian Rumanyika, the Acting Assistant Commissioner-Public & Corporate Affairs at URA said that the tax body has over 1.2 million registered tax payers.

“The total number of tax payers stood at 1,260,290 as at end March 2018,” Rumanyika said.

Asked if URA is satisfied with the figure, he said: “Of course we cannot say we are satisfied with this number; our wish is to have as many taxpayers as we can on the register.”

He however said they have to consider a number of factors-from the economic and policy side.

“The informality of our economy, the large non-monetized and cash based activities make taxpayer identification a nightmare. That said, we have implemented a number of initiatives which have seen our direct tax register grow by close to 72% from 729,793 in March 2015 to 1,260,210 in March 2018,” he said.

On overtaxing a few Ugandans and crippling businesses, Rumanyika said taxes are not in any way crippling business.

“You and I contend that Pareto principle holds everywhere in the world. What you call the 80-20 rule, or 20-80 rule. For instance, it is no surprise that 80% of our revenue can be generated from Kampala District alone which is less than 20% of the country’s total population.

This is because much of the identifiable taxable economic activities are resident here. Similarly, having 80% of our revenue generated from our large tax payer office shouldn’t come as a surprise. This is the trend in most revenue agencies globally.”

He added: “That said, I think our message has always been clear “If everyone pays a little, no one has to pay too much”.

URA Intensifies Efforts To Widen Tax Base

On efforts URA is taking to widen the tax base, Rumanyika said the implementation of the Taxpayer Expansion Project (TREP) where the tax body collaborates with the Uganda Registration Services Bureau and Local Governments across the country to identify and register taxpayers is paying off.

He added that they have also embarked on extensive tax awareness to boost tax morale and encourage voluntary registration and compliance, tax clinics, engagements with stakeholders from public and private sectors, tax debates in universities and secondary schools, taxpayer awards, translation of tax literature, increased participation in corporate social responsibilities and direct engagements with the Ugandan public on social media among others.

“We have simplified processes for both registration and payment of taxes including new guidelines for presumptive taxpayers based on their location and nature of business,” he said, adding that they have expanded their presence through creation of new centres to bring services closer to the Ugandan public.

From the Policy and Legal Perspective, he said many services offered by Ministries, Department and Agencies, financial services provides, obtaining certificates of practice for key professions all require a Tax Identification number, even TINs.

He said they are also doing data matching within and outside their IT systems.

“For instance, matching customs data with e-tax data helps identify taxpayers who import but may be escaping domestic tax payments. Interfaces with IFMIS for Government payments helps identify who the supplies to Central and Local Governments are,” he said.

He noted that the initiatives highlighted above will help them achieve their dream; “If everyone pays a little, no one has to pay too much”.

“A large tax base does not necessarily mean that revenue generation will be even (that is all taxpayers will pay the same amount), it simply means that socially, the burden is shared and once this is achieved, tax morale goes up,” he said.

He noted that to achieve the above dream requires concerted efforts amongst all citizens not URA alone; everyone must do their part.

“The Government must be accountable, Civil Society must create awareness without being counterproductive, and the individual citizens must honor their obligations. This is the journey we traverse every day and I believe together we can fund our budget 100%,” Rumanyika said.